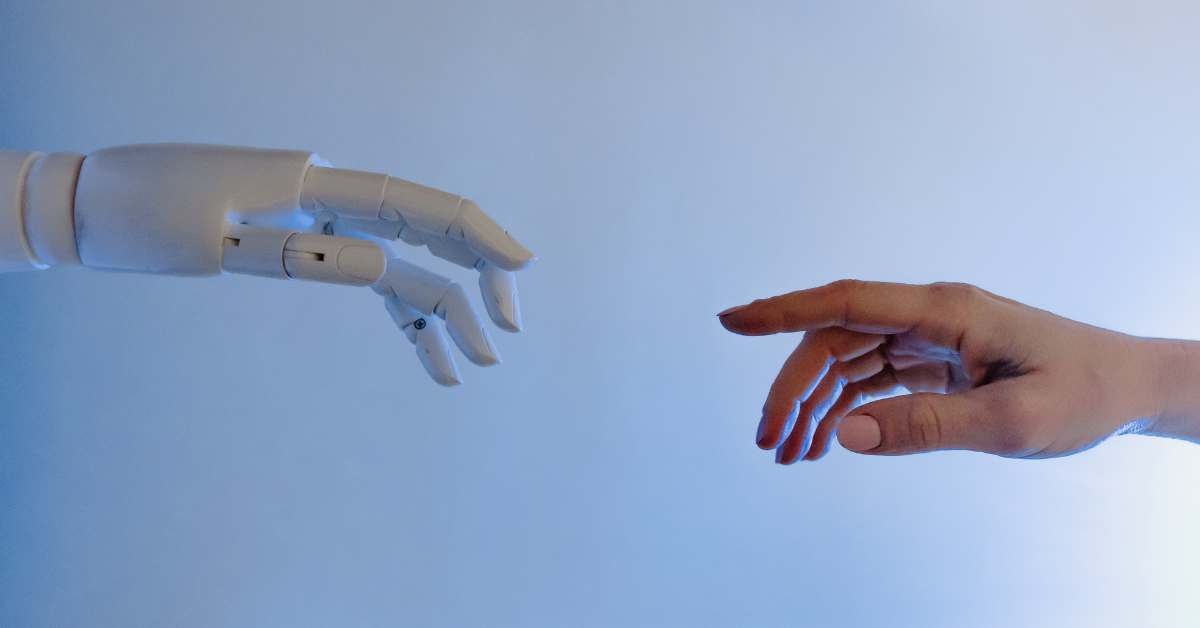

While AI technology has undoubtedly revolutionized various industries, there are certain contexts where the human touch remains invaluable. One such example is the process of buying insurance. While artificial intelligence algorithms can analyze data and provide recommendations, there are several reasons why interacting with a real human is preferable and necessary for a satisfactory insurance experience. Here’s why we think having a real human to consult with when buying insurance is ideal.

Emotional Understanding

Sometimes, purchasing insurance involves discussing sensitive and personal matters. Let’s say you’re trying to make changes to a life insurance policy. To us, we understand that talking about death or disability can be emotional. However, an AI robot trying to sell you life insurance through the computer may lack the ability to empathize and understand the emotional nuances of your specific situation. A human insurance agent, on the other hand, can actively listen, respond compassionately, and provide reassurance during the decision-making process. They’re able to offer personalized advice based on the customer’s unique circumstances, taking into account their emotional needs and concerns.

Complex Scenarios

Insurance can involve intricate policy details, coverage options, and legal terminology that may be challenging for AI systems to explain comprehensively. Human agents, like the ones at Prosper, have the expertise and experience to simplify complex concepts, answer clients’ questions, and address any ambiguities. It’s always our goal to educate and guide our clients to ensure that they’re making well-informed decisions regarding their coverage.

Customization and Flexibility

While AI algorithms excel at processing vast amounts of data and generating recommendations based on statistical probabilities, they may not be as effective at accommodating individual preferences and specific requirements. Humans can offer a higher degree of customization, tailoring insurance packages to suit your unique needs. They can also adapt coverage based on changing circumstances, such as life events or modifications to existing policies, ensuring ongoing satisfaction and a personalized experience. We do this all in the name of helping you feel good about your insurance!

Trust and Accountability

This is so important to us! Establishing trust is essential in the insurance industry. Our clients need confidence that their concerns will be addressed, their claims will be handled fairly and efficiently, and their personal information will be handled securely. Interacting with a real human builds trust through direct communication, providing an avenue for customers to seek clarification, express concerns, and receive personalized support. Having a human point of contact ensures accountability and the opportunity for resolution. After all, a robot isn’t going to invite you to their family’s barbecue but you’re always invited to ours!

Now, don’t get us wrong. AI can undoubtedly enhance efficiency and provide valuable insights into the insurance industry. However, the human touch remains indispensable. Embracing the strengths of AI while preserving the human element allows for a balanced and optimal insurance experience.